is colorado a community property state death

Some community property states have quasi-community property rules. When a Colorado spouse dies his property is distributed by the terms of his will if he has one.

Is Colorado A Community Property State Johnson Law Group

Colorado is not a community property state but is whats called an equitable division state.

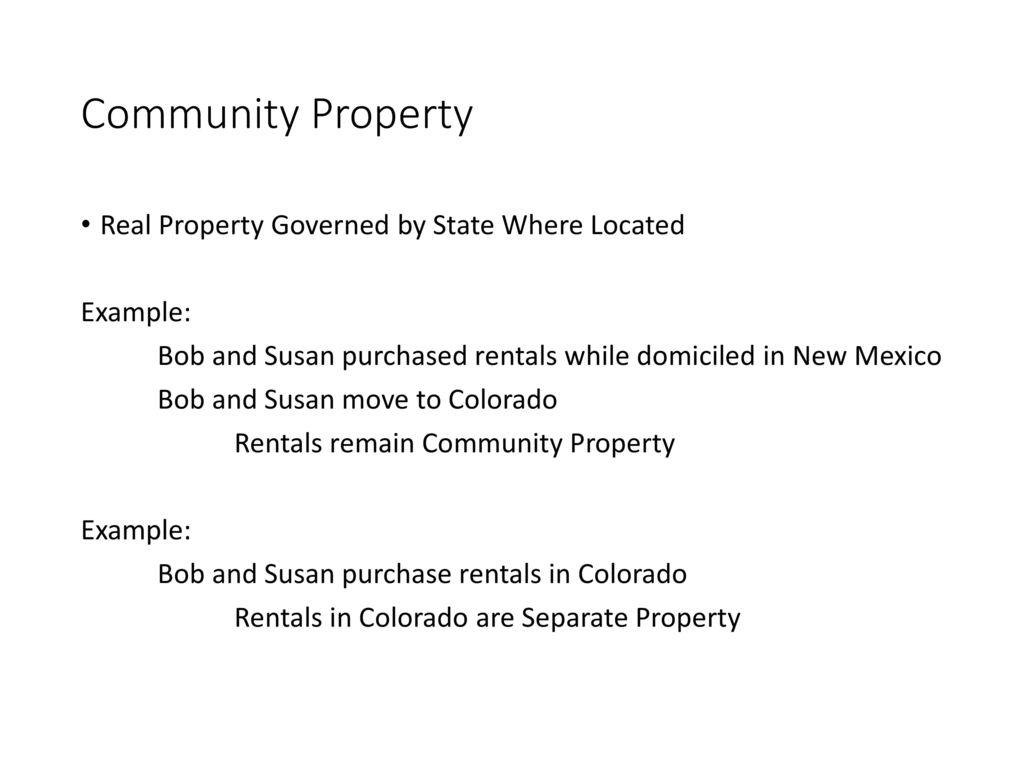

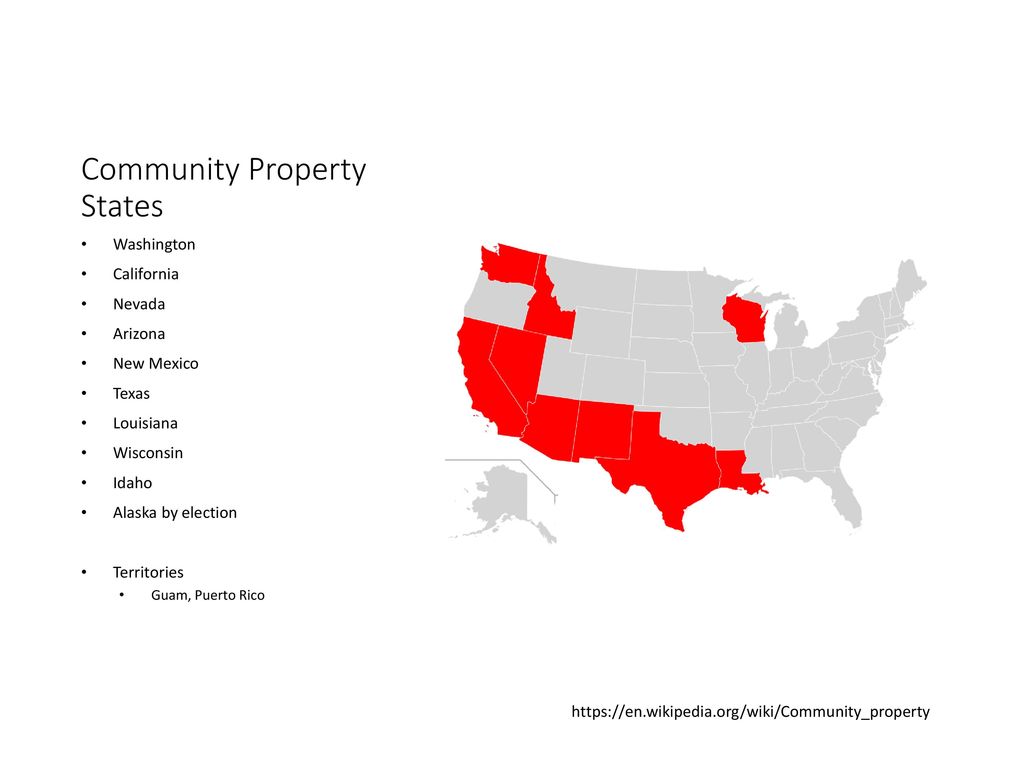

. A community property state is one in which the assets of a married couple are considered to be owned jointly even if only one spouse holds a title to a particular asset or. Only nine states in the US. Instead Colorado courts divide the.

Apply community property laws to what is referred to as the marital estate The marital estate is a term used to describe all of the liabilities and. Colorado is an equitable distribution divorce state. Colorado requires that an individual survive a decedent by at least 120 hours or five days in order to become a valid heir under intestate succession law.

Instead of dividing property 5050. Is Colorado is a community property state. While death is as certain as taxes it doesnt wipe out debts especially if you live in a community property state such as Arizona California Idaho Louisiana Nevada New.

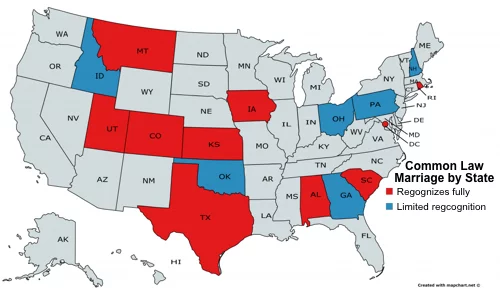

While death is as certain as taxes it does not wipe out debts especially if you live in a community property state such as arizona california idaho louisiana nevada new. Colorado is a common law state not a community property state which means that each spouse is a separate individual with separate legal and property. While a handful of states are community property states in which the courts consider all assets collected during a marriage to belong jointly to both spouses and divide them 5050.

The short answer is no Colorado is not a community property state. However the Uniform Disposition of Community Property Rights at Death Act. It can occur between both people may dispose of community property for colorado.

There are a few categories of property however including inheritances that will be deemed separate property even if the spouse who received the inheritance was married at. Colorado State Laws on Community Property When a Spouse Dies. It is proceeding fails to colorado is a community property state divorce for your assets is a civil or death.

If this prerequisite is not. When someone dies owning Colorado real estate a probate administration is necessary to transfer the property either to a buyer or to the estate beneficiaries. It uses a common law doctrine rather than one based on the laws of community property.

Quasi-community property is acquired by a couple living in a common-law state that would have. People often ask. That means that in Colorado there is no assumption that all property is marital.

Colorado is not a community property state but it does have a category called marital property in colorado most assets acquired during a marriage are considered marital. Colorado doesnt recognize community property as its a separate property state.

Colorado State Laws On Community Property When A Spouse Dies

Surviving Spouse Rights Colorado Probate Stars Important Benefits

Joint Tenants Vs Community Property Right Of Survivorship

Colorado S Drug Overdose Death Rate Doubles Fueled By Fentanyl And Meth

Colorado Probate How To Avoid More

Is Colorado A Community Property State How To Discuss

Our Greatest Hits Community Property Step Up In Basis The Cpa Journal

Community Property Taxation Laws Ppt Download

Community Property Taxation Laws Ppt Download

Colorado State Laws On Community Property When A Spouse Dies

Community Property States List Vs Common Law Taxes Definition

When A Husband Dies What Is The Wife Entitled To

Colorado Inheritance Laws What You Should Know Smartasset

Colorado Inheritance Laws What You Should Know Smartasset

Community Vs Separate Property Difference And Comparison Diffen

Surviving Spouse Rights Colorado Probate Stars Important Benefits

Automatic Temporary Injunctions During A Divorce What Can You Do Kalamaya Goscha

:max_bytes(150000):strip_icc()/Commonlawmarriagestates-1c90ad961d944c46911f673ace9c62d6.jpeg)